Axelar - 7. Post-op Interop

Mthodology and project overview

Axelar’s first ecosystem project, Squid, launched last week as a cross-chain liquidity router.

==Task==

Analyze the impact of Interop Summit on volume for Axelar's Satellite Bridge and Squid Router.

From the tweet below, Squid's Volume has increased by 30%. Was this volume increase from net new users, or existing users reusing the bridge?

In addition, analyze the next transaction done by users after their Squid swap. How quickly after the swap are users using the tokens they swapped into? What contracts/protocols are they interacting with?

Method

This dashboard consists of 6 main sections. In the first 5 parts, Ethereum, Binance, Arbitrum, Avalanche and Polygon blockchains have been examined and analyzed in terms of volume and number of swaps, number of users, from a general perspective, tokens and routes. In the final part, all these blockchains and paths are compared in terms of the mentioned criteria.

What is the Squid Protocol & how does it enable cross-chain liquidity?

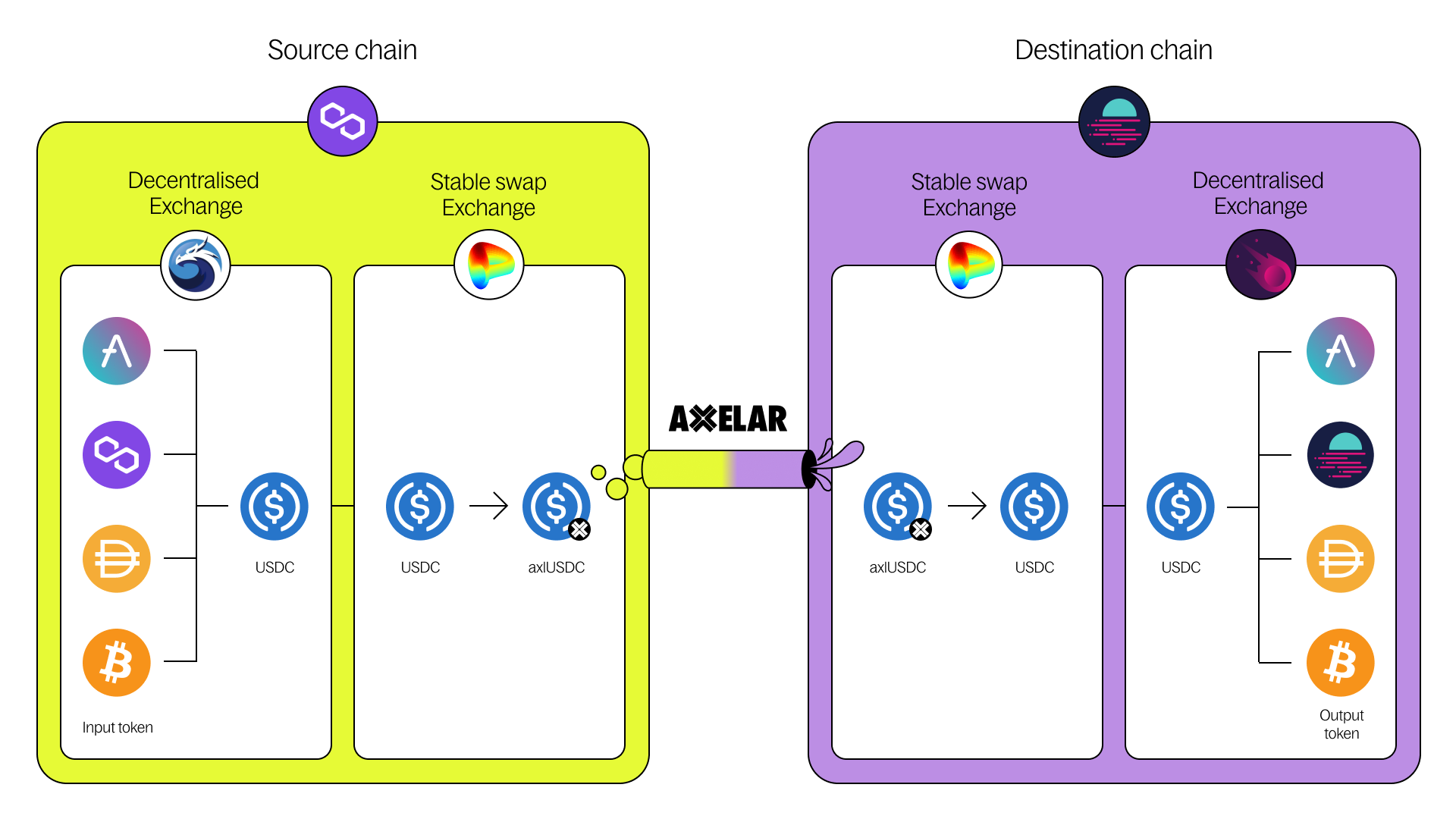

Squid is delivering the cross-chain future for both developers and users. For developers, Squid is a protocol that enables cross-chain liquidity routing and swaps through a single Javascript software development kit (SDK). This routing allows for the swapping of any tokens across all the supported chains, by connecting users to liquidity pools on dexes anywhere in Web3. The SDK works by getting a route that returns the details of the token transfer and the cost to execute it. Developers can then execute the transfer with the required signer and route.

Squid uses Axelar's General Message Passing capabilities to enable smart contract calls across multiple chains. Using the multicall feature of Squid, applications can call multiple contracts in sequence. Use cases might include swapping tokens using a dex on another chain, then using the acquired tokens in another dApp. This feature delivers cross-chain liquidity, and saves time for both users and developers as a signature for the second transaction is not required.

What this means for users is one-click transactions. They will not need to download multiple wallets to sign the transactions across different chains. Users can buy NFTs from any marketplace, play a game on another chain or transact with multi-chain DeFi protocols, without any extra steps. Squid enables dApps to source cross-chain liquidity and deliver this kind of experience, using security provided by the Axelar network.

Axelar Network is a blockchain platform that facilitates cross-chain communication and enables developers to build decentralized applications (dApps) that span multiple blockchain networks. The network has been designed to be scalable, secure, and interoperable, and it allows blockchain platform builders to seamlessly plug-in their blockchains using its open API.

Axelar uses a novel consensus mechanism called the Proof-of-Relay, which helps secure cross-chain transfers and transactions. The platform's smart contract system supports multiple programming languages, including Solidity, Rust, and Vyper, which makes it easier for developers to build dApps of their choice.

Recently, Axelar has been making significant strides to expand its ecosystem. They have introduced a startup funding program to encourage more innovative projects to be built on their network. Additionally, they continue to explore new partnerships and collaborations within the blockchain industry to drive the adoption of their network.

If you want to stay updated on the latest news and updates about the Axelar network, you can check out their Medium blog and YouTube channel.

Observations

- Looking at the results , it is pretty obvious that the Interop Summit made a great and positive effect on the bridging volume using Satellite . in the past 30 days , the highest amount of bridging occurred on March 11 with 95M$. On that day , the highest average bridging amount also has occurred.

- In terms of senders , just like as amount, a dramatic increase can be seen.

- Cumulative bridge amount also shows how that special day made a deep and positive impact on Satellite adoption.

- Looking at the results, it can be seen that, average bridging volume $ per day was 14M$ before Interop, which has reached to 15M$ ! it shows a 7% increase .

- Also, average bridging volume $ per txn was 1.9k$ before Interop, which has reached to 2.2k$ ! it shows a 15.7% .

- it seems that most of bridge volume came from older users but new users had a good contribution too.

Conclusion

-

In this project, the impact of the recent Interop on the performance of two popular bridges of the Excel network, Squid and Satellite, was investigated. Investigations showed that after that incident, all the metrics related to these platforms, including the dollar value of the transfer, the average transfer, the number of transactions and the number of users, have all experienced significant growth.

-

In the meantime, it goes without saying that the impact of interop on Squid was much higher than on Satellite, and as seen, in the average transfer per day and transaction, we saw a growth of 4 to 8 times on this platform.

However, the usage rate of Satellite is still higher than its competitor.

Observations

- Looking at the results , it is pretty obvious that the Interop Summit made a great and positive effect on the bridging stats using two strong platforms . in the past 30 days , the highest amount of bridging occurred on March 11 with 632k $. On that day , the highest average bridging amount also has occurred.

- In terms of senders , just like as amount, a dramatic increase can be seen.

- Cumulative bridge amount also shows how that special day made a deep and positive impact on Satellite and Squid adpotion.

Observations

- Looking at the results , it is pretty obvious that the Interop Summit made a great and positive effect on the bridging volume using Squid . in the past 30 days , the highest amount of bridging occurred on March 11 with 1.15M$. On that day , the highest average bridging amount also has occurred.

- In terms of senders , just like as amount, a dramatic increase can be seen.

- Cumulative bridge amount also shows how that special day made a deep and positive impact on Squid adoption.

- Looking at the results, it can be seen that, average bridging volume $ per day was 32k before Interop, which has reached to 296k$ ! it shows a 8.25x increase which is incredible !

- Also, average bridging volume $ per txn was 241$ before Interop, which has reached to 975$ ! it shows a 4x increase which is incredible !

- it seems that most of bridge volume came from older users but new users had a good contribution too.